(Bloomberg) — Wall Boulevard’s waning conviction in Coinbase World Inc. has executed little to discourage Cathie Picket. As an alternative, she’s been scooping up stocks of the suffering cryptocurrency alternate within the wake of the cave in of Sam Bankman-Fried’s FTX.

Maximum Learn from Bloomberg

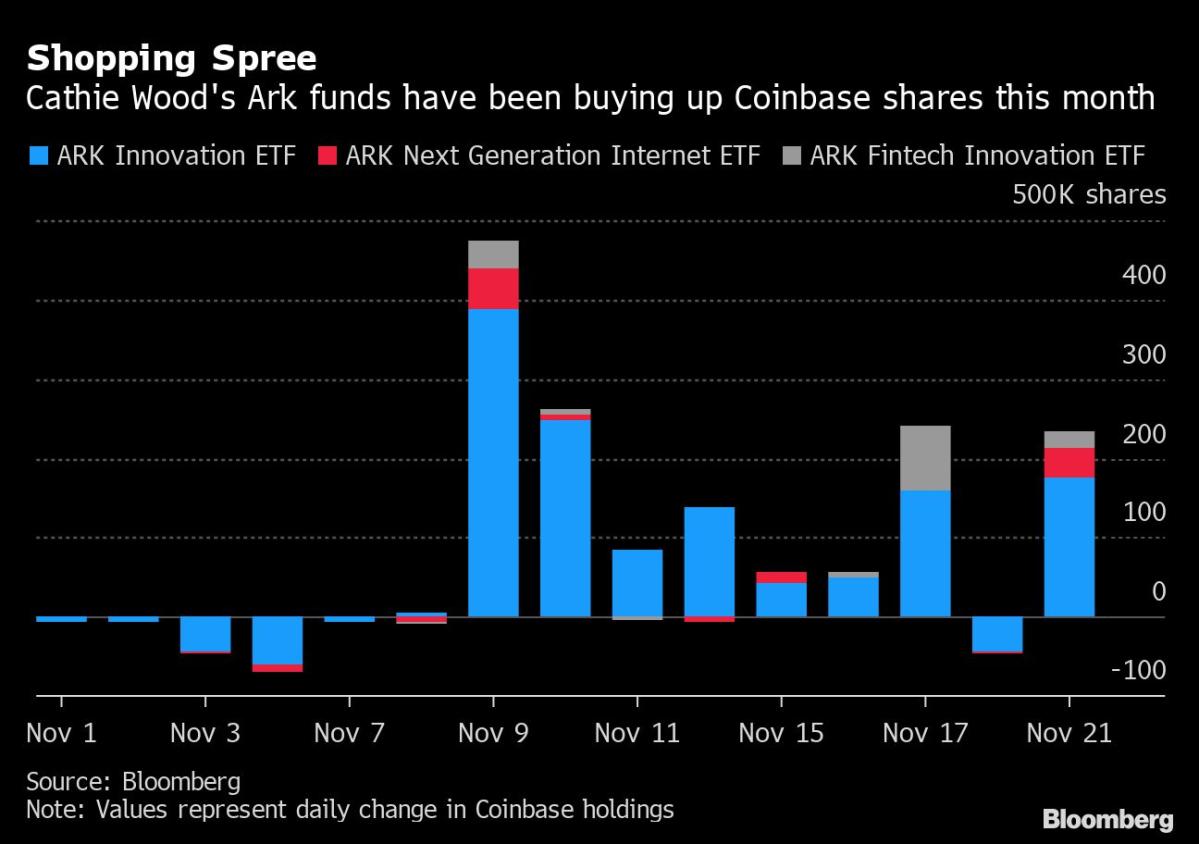

Picket’s Ark Funding Control finances have purchased greater than 1.3 million stocks of Coinbase because the get started of November, price about $56 million in response to Monday’s buying and selling worth, in line with knowledge compiled by way of Bloomberg. The buying groceries spree, which began simply as FTX’s death started, has boosted Ark’s general holdings by way of kind of 19% to about 8.4 million stocks. That equates to round 4.7% of Coinbase’s general exceptional stocks.

Ark finances have additionally been including to stakes in different cryptocurrency-related sources, specifically Grayscale Bitcoin Believe and stocks of crypto financial institution Silvergate Capital Corp. in fresh weeks. The greater purchasing from Picket dollars the wide crypto selloff this yr, together with slides in tokens reminiscent of Bitcoin and Ether.

Coinbase first of all rebounded within the days following Ark’s first acquire on Nov. 8, due largely to softer-than-expected US inflation knowledge which despatched risk-assets surging globally. That rally, then again, was once short-lived for the crypto alternate, with its inventory worth falling for 4 consecutive days, together with an 8.9% drop on Monday to near at a report low.

Nearly all of Ark’s Coinbase holdings are from its flagship ARK Innovation ETF which has just about 6 million stocks for a weighting of about 3.6%, the fund’s thirteenth biggest place. Whilst the ARK Subsequent Era Web ETF and ARK Fintech Innovation ETF each and every best grasp simply over 1 million stocks, Coinbase’s weighting within the two finances is a long way upper at 5.4% and six.3% respectively, in line with knowledge on Ark’s website online.

Ark’s renewed pastime in Coinbase stands in stark distinction to the sentiment emanating from Wall Boulevard for the easier a part of the remaining six months. Analysts from companies together with Financial institution of The united states Corp. and Daiwa Securities Team Inc. have downgraded the inventory this month, leaving it with simply 14 buy-equivalent analyst suggestions, its lowest quantity since August 2021.

Learn extra: FTX Cave in Is Shaking Wall Boulevard’s Conviction in Coinbase

In different strikes, ARK Subsequent Era Web bought greater than 450,000 stocks of the Grayscale Bitcoin Believe because the get started of remaining week, as its cut price relative to the price of its underlying cryptocurrency continues to widen. Ark Fintech Innovation bought greater than 200,000 stocks of crypto financial institution Silvergate Capital Corp. remaining week.

Coinbase and Silvergate Capital have each shed greater than 80% in their worth this yr. The ones losses are even deeper than the ones suffered by way of the sector’s two biggest cryptocurrenices — their costs have declined by way of greater than 65% in 2022 with the plunge accelerating this month within the wake of the FTX cave in.

The Coinshares Block Index, which tracks 45 world shares with various publicity to the cryptocurrency sector, was once little modified Tuesday after falling 2.5% within the earlier consultation.

(Updates knowledge on purchasing of Grayscale and Silvergate, efficiency of Coinshares Block Index)

Maximum Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.